|

This is

One Reason Why They Didn't Vote for the 2022 Budget

Historically High

Tax Increases!

|

|

|

City

Council |

|

Historically Approved

Large Annual Tax Increases at Twice the Rate of Inflation

|

| |

|

|

|

|

|

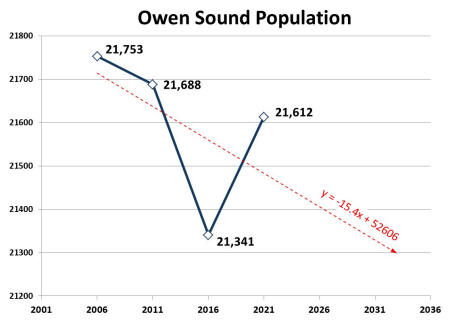

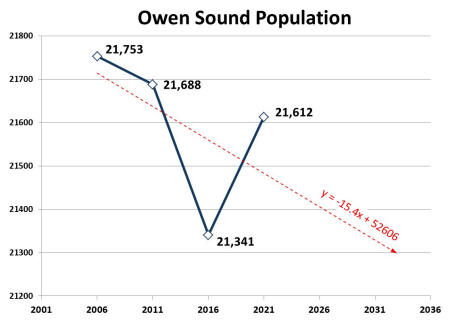

Owen Sound Taxes increased by $8.4 million, or 38% from

2011 to 2020. During the same period inflation increased by only 18.3%.

In other words Owen Sound Taxes have been increasing at more than twice

the rate of inflation. At the same time Owen Sound's population contracted by

nearly 1% from 21,753 in 2001 to 21,612 in 2021. This means that

the cost to the taxpayer to run the city steadily grew while the

population declined. In fact in 2011 total city expenses were $40

million when the population was 21,668 and in 2022 expenses were $55.5

million when the population was slightly smaller at 21,612. So it

cost $15.5 million more today to run a smaller city than it did in 2011.

That's a 38.7% increase in expenses to run the city with virtually the

same population. Again expenses are growing at more that twice the rate

of inflation. |

|

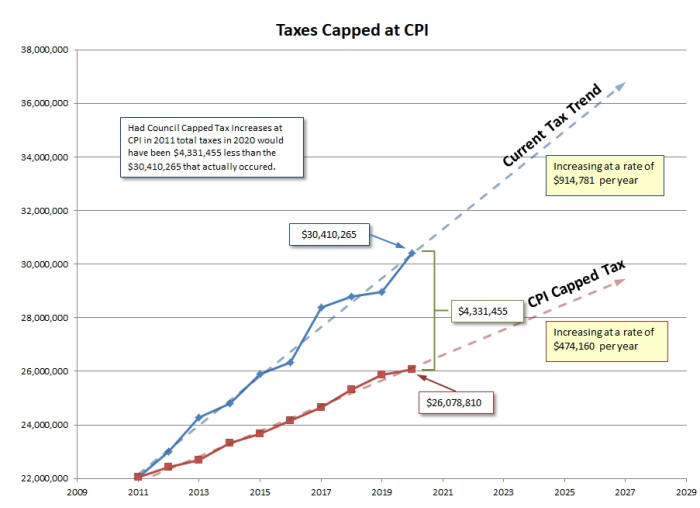

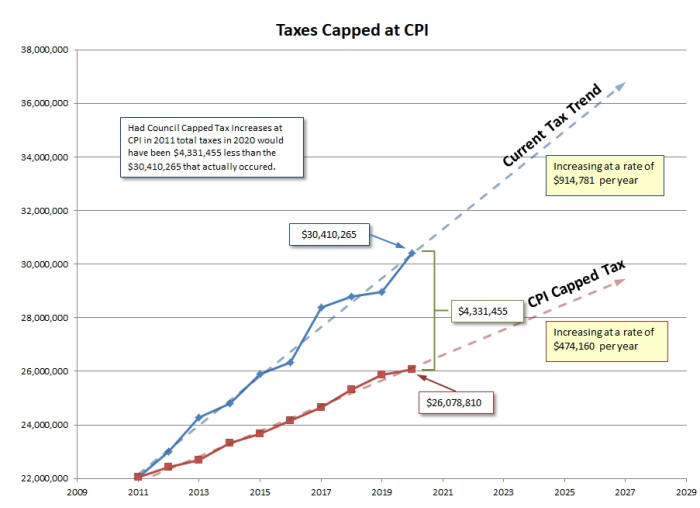

If, in 2011,

Council had directed that all future tax increases be limited to inflation,

then revenue from taxation in 2020 would have been $26,155.388 or $4.3

million less than what actually occurred. If inflation continues at the same

rate and if tax increases had been capped at CPI in 2011, then taxes would

reach $29,948,668 by 2028 which is actually $2.5 million less than what they

are today.

The bottom line is that

there is no valid reason for Council to approve annual tax increases that are

greater than inflation - yet they have been doing it for years.

return home

Learn More

|