Budget Process Improvements – Part III

Putting things in Perspective

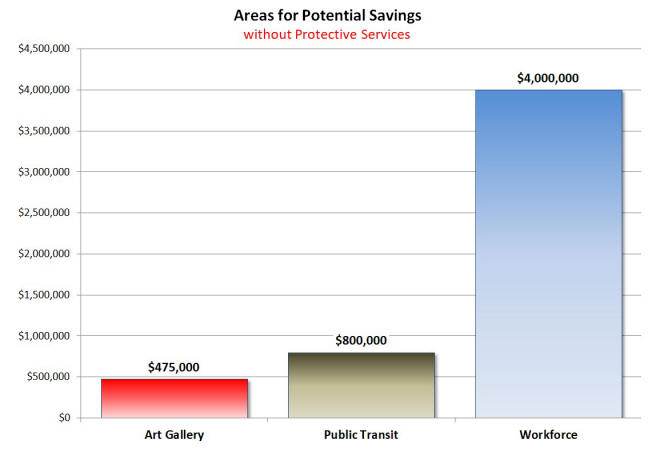

When we graphically represent the three potential areas for savings, as shown below, it becomes pretty obvious where we should look for the “low hanging fruit”. The savings available from both the Art Gallery and Public Transit are clearly over shadowed by the potential savings available from workforce reductions. Therefore the initial focus for savings should be staff reductions.

|

|

|

Figure 5; Relative Size of the Three Potential Areas for Savings |

An Historical Review

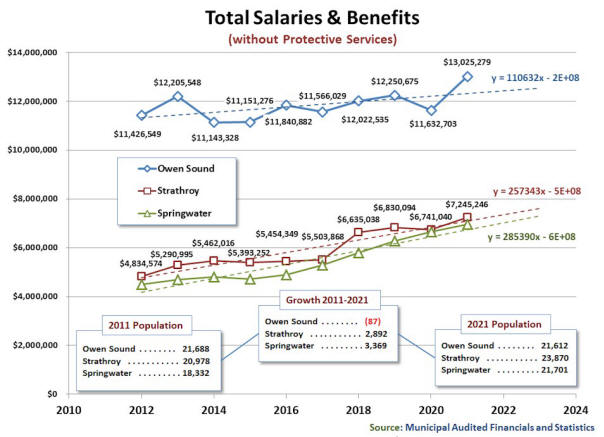

The only question that remains is; how did we get to our current situation where our municipal workforce is grossly over staffed in comparison to other similarly sized municipalities? My initial belief was that this disparity was created by Councils over the past 20 years or so by approving excessively high annual increases in expenses. However when I examined the changes in Salaries and Benefits expenses over a ten year period for Owen Sound and two other municipalities, I found that I was mistaken. Owen Sound’s problem has existed for a much longer time period.

Owen Sound’s Salaries & Benefits expense in 2011 was more than twice that of either Strathroy or Springwater as shown in the chart below. By 2021 this difference had reduced somewhat. What this tells us is that, although the Councils over the last ten years added to the problem, they did not create the problem. This disparity likely originated as much as 40 to 50 years ago and each Council over this period added a little to the problem until we got to where we are today. I suspect that each of these Councils failed to ask the critical questions at budget time; such as, if our population is not growing why do you need hire more staff to run the city?

|

|

|

Figure 6; Historical Changes in Salaries & Benefits Expense |

As you can see from the

above, Owen Sound actually had 87 residents fewer residents in 2021 than it had

in 2011. Yet, Owen Sound’s Salaries & Benefits expense grew by $1.6 million.

This suggests that there were at least some additions to the workforce during

this period. However, it’s quite clear, a preponderance of the problem

originated prior to 2011.

|

|

Summary

1. In order to have ongoing vigilance when it comes to reviewing the annual budget Council needs to do a detailed, line by line, review of each and every department budget. To facilitate this the budget review period needs to be extended from two days to two weeks and members of council properly compensated for their time.

2. In addition to a rigorous annual budget review significant one-time expense reductions are necessary to close the gap in taxes with Georgian Bluffs within a reasonable timeframe. Two of the candidates examined for reductions, the Art Gallery and Transit Services are overshadowed by the potential savings available from staff reductions and for the time being should not be considered candidates for reduction.

3. Owen Sound’s workforce has grown well beyond that employed by other, similarly sized, municipalities and has been excessively high for many years. The workforce in general is much larger than needed. The management team is, at a minimum, carrying 6-9 managers more than needed in comparison with other similarly sized municipalities.

4. Staff reductions should be done over a 4 to 5 year period and should consist of a combination of retirement incentives, internal transfers and as a last resort, involuntary terminations. Each internal transfer should be accompanied by a comprehensive retraining program.

5. The target for Salaries and Benefits expense, excluding Protective Services, should be $9 million to bring Owen Sound in line with the average Salaries and Benefits expense of similar municipalities. This will require this line item to be reduced by $4 million.

6. Although the current Council did not contribute to this problem in the 2023 budget, unlike other Councils have over the past 50 years, it is this Council that needs to find the courage to take all steps necessary to bring Owen Sound’s taxes in line with our surrounding municipalities within a reasonable timeframe.

The Approach to Staff Reductions is Critical

How you approach the task of reducing a public service workforce, which has gradually grown over a long period of time, will make the difference between success and failure. Every effort should be made to encourage voluntary departures and internal transfers to minimize the impact on employees and their families.

“Right-sizing” the workforce cannot be achieved without a proactive and effective communication strategy and can only be seamlessly achieved if spread over several years. In this case I would suggest 4 to 5 years. In regard to communication it is vitally important to be fully transparent with all employees on the need for the reductions and to develop effective communication with union leadership Protective Services should be excluded from the reductions at this time and a comprehensive study of Protective Services should be initiated given their annual Salaries and Benefits cost of $14 million is greater than all other departments combined.

Notes to Members of Council

1. I identified the problem for you and showed you how it came to be. In addition, I gave you the evidence that will justify the bold steps needed to do the right thing for Owen Sound taxpayers.

2. It is now up to you to take the decisive action needed to adequately address the problem within a reasonable timeframe. I know from personal experience that downsizing a public service workforce is both challenging and emotionally taxing. However, this cannot be avoided and “right-sizing” the workforce should be your #1 priority this year.

3. Do not approve the 2023 budget at this time. This cannot be put this off for another year. You must act now.

4. The current draft budget shows some progress has already been made. To complete this for the 2023 budget year an annual reduction in the order of $600,000 is needed. Staff reductions should include a voluntary early retirement and internal transfer programs. If you make it sufficiently attractive you could achieve this year’s goal without the need for forced terminations.

5. A reduction of $600,000 in Salaries and Benefits expense should become a firm commitment by writing it into the 2023 budget. A separate global line item for “Incentives and Severance” should be established to ensure that reductions in Salaries and Benefits expense are clearly identified in each department's budget while not burdening them with the Incentives and Severance expense.